Are you in need of a new HVAC system, and trying to choose between an air source heat pump and a gas furnace? We’re here to explain why going with a heat pump is a no-brainer. In comparison to their gas counterparts, heat pumps are…

- a smart investment for your home

- less expensive to install in many cases (thanks to the fantastic with tax credits and rebates that are currently available)

- healthier and safer for your family

- the best modern tech available for your home

- the more energy efficient option

- the perfect foundation for a Climate-Friendly Home

Learn more about each of these points in a deep dive comparison of air source heat pumps and furnaces below:

Gas furnaces vs. heat pumps: which is the right HVAC system for me?

Let’s start with the obvious – we know it can be pretty overwhelming to replace a heating and cooling system in your home. Oftentimes, it happens during a literal make-it-or-break-it moment – your house needs heating or cooling as soon as possible because your current system has broken. And, let’s be honest, it’s expensive. For the average homeowner, their HVAC system is the third largest investment they’ll make, behind their home and car. It’s important to get this right, and we’re here to help.

First, we recommend making a plan so you don’t find yourself in this stressful situation. Second, let’s dive in – why would you want to switch from a gas furnace, the system you’ve always known?

Simple: heat pumps are the best and most efficient technology you can get your hands on, they’re good for your wallet and the climate, and there are loads of incentives (we’re talking federal, state, local, and utility) that defray the upfront cost of installation…and that free money won’t be available forever. There’s no time like the present.

Heat pumps are a smart investment

The first question when replacing any large equipment in your home is probably, “how much is this going to cost me?”

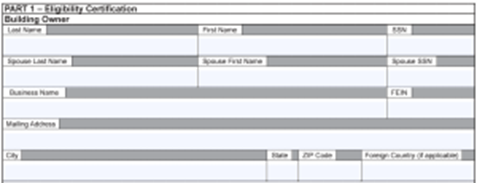

| Heat Pumps | Furnaces | |

|---|---|---|

| Functionality | Heating and air conditioning, gentle and evenly distributed | Just heating, blasts hot air on and off |

| Upfront installation costs | $7,500-20,000 (after incentives, see table below) | $6,000-24,000 (no incentives) |

| Available incentives | At least $2,000 tax credit, and depending on where you live, often more that are stackable. Colorado and Massachusetts, see links for more information. | None |

| Operating costs | Lower – on average, our customers save hundreds, and in some cases more than $1,000 per year on utility costs | Higher |

| Energy efficiency | 300% more efficient than furnaces | Less efficient |

| Lifespan | 15-25 years | 20 years |

These general costs cover a wide range of numbers, mostly dependent on the size of your home and its heating and cooling needs. Want a quick estimate of how much it’ll cost you?

All in all, thanks to the robust rebates and tax credits available to offset the costs of these systems (we’ll explain more below), in most instances, installing a heat pump today is less expensive than installing a new furnace and air conditioner/central air system, and it will help you save on operating costs in the long run, too.

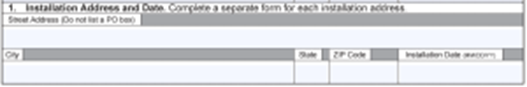

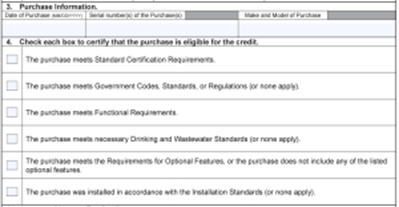

| Cost | Explanation |

|---|---|

| $23,000 | Cost of Cold Climate Heat Pump + Electrical Upgrades, before incentives |

| ($2,200) | Xcel Rebate (upfront to Elephant Energy) |

| ($3,500) ($1,200) | Denver CARe Heat Pump Rebate (upfront to Elephant Energy) Denver CARe Electrical Rebate (upfront to Elephant Energy) |

| ($2,000) | Federal Tax Credit from Inflation Reduction Act |

| ($1,200) | State of CO Heat Pump Discount |

| = $10,100 | Total incentives |

| = $12,900 | Total cost, after incentives |

Beyond this federal powerhouse, many states and cities have adopted rebates and incentives for installation of heat pumps in homes. In the greater Denver area, there are multiple options to choose from (and they can be stacked with energy utility rebates, too!) For the Boston Metro, Mass Save® is a fantastic program with super robust rebates for heat pumps (up to $10,000 for single family homes!). A quick internet search of your city’s name + “heat pump incentives” may find you more money back than you were expecting.

Health and safety for you and your family

A recent study found that children living in a home with a gas stove have a 42% increased risk of experiencing asthma symptoms. When it comes to your family’s health, it makes a difference to switch from a gas stove to an induction stove, a gas furnace to a heat pump, and a gas-burning water heater to a heat pump water heater.

Why? A heat pump runs solely off of electricity. This is safer than burning gas, which in turn releases fossil fuels into your home – and impacts the air you’re breathing every day. (And yes – the same goes for the gas stove and your fuel-burning cars, too.)

The best modern tech in the HVAC market

As we explained in our introduction to heat pumps blog, heat pump technology has been around for many years, but it’s improved tremendously over the past ten years. This means you’re selecting an advanced piece of equipment to join your home appliance lineup that is better for the environment, better for your wallet, and going to last you in the long run. With natural gas beginning to be phased out, you won’t want to be delayed in making the switch!

With the push made by federal, state, and local governments to make the transition to energy efficient appliances and away from fossil fuels, you can trust that you’re investing in the best tech for your home today. Plus, homes that install heat pumps see a 4-7% increase in home value. Not too shabby!

Along with the smart investment of great tech comes the promise of a better user experience when you’re choosing a heat pump over a gas furnace. Heat pumps are much quieter than a gas furnace, which blasts on any time your home is not at the set temperature on your thermostat. Then, when it reaches that temperature, the furnace kicks off. It repeats this pattern all day and all night – on, off, on, off. In contrast, the heating and cooling produced by a heat pump are much more gentle and even, because they run quietly on a low setting in the background at all times.

If you had to choose between a late 90’s desktop computer you had to lug around everywhere you went or a new laptop, you’d almost certainly choose the latter. Beyond it being kind of embarrassing to be sporting outdated tech, the ease of use, convenience, and affordability over time of a desktop pale in comparison to a modern day laptop. We trust that you get where we’re going here.

In this round of heat pump vs furnace, it’s heat pump all the way. Your future self will thank you!

Energy efficiency meets environmentally friendly

For years, we burned stuff to make heat. We burned stuff to drive cars and cook our food, too. But we’re here to tell you – you don’t need to burn stuff anymore to heat your home.

Did you know that our homes account for 20% of climate-related emissions each year? Most of that is from heating and cooling. Yikes! By electrifying your home and using clean energy (like solar), it’s possible to completely eliminate those emissions. Pretty cool, right?

What about the impact of simply installing a heat pump, though? Research shows that in all 48 continental states, replacing a gas furnace with a heat pump will reduce emissions within the very first year of installation and across the 15-year lifespan of the product. While the exact amount of emissions reduction varies by state, in many places, the reduction is up to 93% over the lifetime of the heat pump. You can read more about this research and see the specific projections for the state you live in here.

Either way, the proof is in the pudding — if you care about reducing your footprint, installing a heat pump is the way to go.

Heat pumps: the clear winner when it comes to choosing HVAC for your home

Going for a heat pump over a furnace? Smart move. You’re getting cutting-edge tech that saves you money in the long run, thanks to incentives and lower energy bills. Plus, it’s a win for comfort and health at home – steadier temps and cleaner air. It’s a solid choice all around.

If you’re wanting to embrace climate action on a personal level, heat pumps are also a great option for that. Check out this personal climate calculator to see how much your heating and cooling makes a difference in your home.

Ready to get started? Join us in building a brighter future by electrifying everything, starting with homes. Your choice today shapes our collective tomorrow!