Does Colorado have a rebate for heat pumps? No – but we do have a new Colorado State tax credit for heat pumps and heat pump water heaters that went into effect on January 1, 2023. This guide is only for heat pumps installed in the state of Colorado in 2023.

- The tax credit is an income tax reduction based on 10% of the price of the equipment, not including installation charges.

- The 10% tax credit also extends to electrical panel upgrades (if needed for the heat pump or heat pump water heater installation) and energy storage systems.

- Inclusive Definition: “Building owners” encompass lessees with lessor-approved installations.

How to Claim / File for the Income Tax Credit:

What is the Colorado energy tax credit for 2024? Simply fill out Form DR 1322 to take advantage of your 2023 heat pump install. This must accompany the building owner’s Colorado income tax return. This is how you will receive the Colorado heat pump tax credit. Instructions below.

Note: If you are an Elephant Energy customer, download and use this Form DR 1322 as it is signed by us.

Disclaimer: While we provide guidance, it’s crucial to seek advice from a tax professional regarding individual tax situations. Our presentation doesn’t assume liability for your specific tax circumstances.

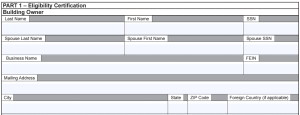

- PART 1 – Eligibility Certification

-

- Building Owner Information: Fill in your name, Social Security number, and address. Include your spouse’s details only if filing jointly. If the building owner is a business, provide its name and Federal Employer Identification number.

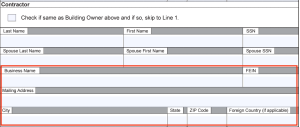

- Contractor:

- Business Name: Elephant Energy, Inc.

- FEIN: 61-1992874

- Mailing Address: 1390 Yellow Pine Avenue

- City: Boulder

- State & Zip Code: CO 80304

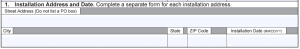

- Line 1 Installation Address and Date: List the street address of the building where the heat pump or heat pump water heater was installed.

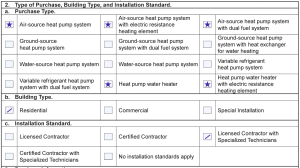

- Line 2 Purchase Type, Building Type, and Installation Standard

- For purchase type, select the relevant purchase made from one of the highlighted products that Elephant Energy supplies below (with star).

- For building type, choose “Residential”.

- For Installation Standard, check “Licensed Contractor with Specialized Technicians”

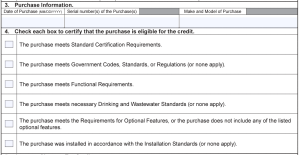

- Line 3 Purchase Information: provide the purchase date, serial numbers of the main components of the heat pump or water heater, along with their make and model details. This information is in your invoice from Elephant Energy.

- Line 4 Certification of System Requirements and Installation Standards: Elephant Energy can confirm that its installations meet all 6 criteria.

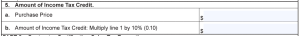

- Line 5 Amount of Income Tax Credit

- On Line 5a, input the equipment-only cost (do not include labor cost). Please refer to your invoice for this breakdown.

- On Line 5b, calculate your heat pump system or water heater credit by multiplying the amount from Line 5a by 10% (0.10). This resulting figure represents your eligible credit. If you’re not assigning the credit, transfer this amount to the appropriate credit schedule (DR 0104CR, DR 0106CR, or DR 0112CR).

- Building Owner Information: Fill in your name, Social Security number, and address. Include your spouse’s details only if filing jointly. If the building owner is a business, provide its name and Federal Employer Identification number.

- PART 2 – Contractor Certification Sales Tax Exemption – Elephant Energy installations have already taken the sales tax exemption so there is nothing for you to do here.

- PART 3 – Election Statement for Assignment of Income Tax Credit – Elephant Energy systems are not eligible for assignment back to Elephant Energy.

And once again, thank you for being a part of the Elephant Energy Herd!! You know that heat pumps are a good option for Colorado residents, and we couldn’t be where we are without wonderful customers like yourselves. We’re here for you – before, during, and after your Climate-Friendly Home upgrade.

Do heat pumps qualify for federal tax credit? Yes! Check out our guide here.