At Elephant Energy, we’re all about helping you make your home more energy-efficient, climate-friendly, and affordable. The Colorado State Heat Pump Tax Credit is a fantastic opportunity to save money while upgrading your home’s energy systems. Designed to tackle greenhouse gas emissions and promote sustainable living, the Colorado Heat Pump tax credit makes it more affordable to transition to cleaner, greener energy systems. This guide makes navigating the process and claiming your tax credit easy.

What is the Colorado Heat Pump Tax Credit?

The Colorado State Heat Pump Tax Credit is a new incentive, launched on January 1, 2023, that offers homeowners a 10% income tax reduction on the cost of eligible equipment, excluding installation charges.

What Expenses Are Covered?

- Heat pumps

- Heat pump water heaters

- Electrical panel upgrades (if required for the installation)

- Energy storage systems

Why Choose Heat Pumps?

Heat pumps are one of the best ways to make your home more energy-efficient while reducing environmental impact. Plus, the Colorado Heat Pump credit makes it more affordable than ever to make the switch!

- This guide applies to heat pumps installed in Colorado in 2023. We’ll update this page with 2024 eligibility details as soon as they’re released—check back soon!

Who Qualifies for the Tax Credit?

If you own a residential building in Colorado or lease a property and have the lessor’s approval for installation, you’re eligible for the Colorado Heat Pump credit. Eligible systems must meet Colorado’s installation standards and be installed by a licensed contractor — if you’re an Elephant Energy customer, you’re already covered!

How to Claim the Colorado Heat Pump Tax Credit

Claiming your Colorado Heat Pump Tax Credit is easy when you know what to do. Below, we’ve outlined each step* to help you navigate the process with confidence — saving you time and ensuring you get the credit you deserve!

*Disclaimer: While we provide guidance, it’s crucial to seek advice from a tax professional regarding individual tax situations. Our presentation doesn’t assume liability for your specific tax circumstances.

| Are you an Elephant Energy customer? Great news! Your Form DR 1322 is ready and signed—just download it to fast-track your tax credit filing process. |

Step 1: Gather Your Documents

You will need:

- Your completed Form DR 1322 (available for download).

- Your invoice that shows the equipment cost (not installation charges), make, and model.

- Equipment serial numbers.

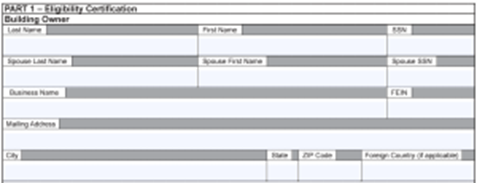

Step 2: Fill Out Part 1 – Eligibility Certification

Building Owner Details:

- Enter your name, Social Security number, and address.

- If you’re filing jointly, include your spouse’s information.

For businesses: Enter your company name and Federal Employer Identification Number (FEIN).

Contractor Information:

- Business Name: Elephant Energy, Inc.

- FEIN: 61-1992874

- Mailing Address: 1390 Yellow Pine Avenue

- City: Boulder

- State & Zip Code: CO 80304

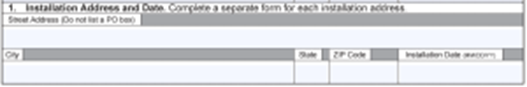

- Line 1: Installation Address and Date: Add the address where the system was installed and the installation date.

- Line 2: Purchase Type, Building Type, and Installation Standard

- For purchase type, select the relevant purchase made from one of the highlighted products that Elephant Energy supplies below (with star).

- For building type, choose “Residential.”

- For Installation Standard, check “Licensed Contractor with Specialized Technicians”

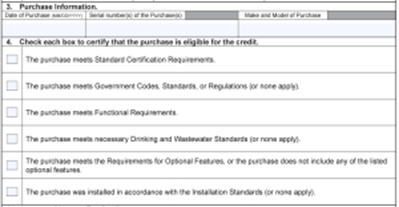

- Line 3: Purchase Information: Provide the purchase date and serial numbers of the heat pump or water heater’s main components, along with their make and model details. This information is in your invoice from Elephant Energy.

- Line 4: Certification of System Requirements and Installation Standards: All Elephant Energy installations meet the required system and installation standards, so this is pre-verified for our customers.

- Line 5: Amount of Income Tax Credit:

- Line 5a: input the equipment-only cost (do not include labor cost). Please refer to your invoice for this breakdown.

- Line 5b: calculate your heat pump system or water heater credit by multiplying the amount from Line 5a by 10% (0.10). This resulting figure represents your eligible credit. If you’re not assigning the credit, transfer this amount to the appropriate credit schedule (DR 0104CR, DR 0106CR, or DR 0112CR).

Additional Tax Credit Details

Sales Tax Exemption (Part 2 – Contractor Certification)

Good news! If Elephant Energy installed your heat pump or heat pump water heater, we’ve already accounted for the sales tax exemption during the process. There’s nothing further you need to do for this section when filing your tax credit.

Assignment of Tax Credit (Part 3 – Election Statement)

Please note that Elephant Energy systems are not eligible for assignment of the tax credit back to the contractor. This means the tax credit stays with you, the homeowner, ensuring you get the full benefit.

Step 3: File Your Tax Return

- Attach the completed Form DR 1322 to your Colorado income tax return.

- Submit your return using your preferred filing method.

Reminder: Consult a tax professional if you have questions about your individual tax situation.

Maximizing Your SavingsFederal Tax Credits Pair the Colorado State Credit with federal incentives to maximize your savings—check out our Federal Heat Pump Tax Credit Guide to learn how you can claim even more! Local Utility Rebates Many local utilities in Colorado offer rebates for heat pump installations. Check with your provider to see what’s available. |

Why Choose Elephant Energy for Your Heat Pump Upgrade?

At Elephant Energy, we’re more than just a service provider — we’re your partner in creating a sustainable, energy-efficient future. From the first consultation to installation and beyond, we’re here to simplify your electrification journey and help you make the most of your investment. With the Colorado heat pump rebates, you can save even more while upgrading to eligible heat pump technology that delivers measurable energy efficiency and tangible environmental benefits.

By joining the Elephant Energy herd, you’ll save money and take meaningful steps toward reducing your home’s carbon footprint. Let us handle the hard parts so you can focus on enjoying the benefits of a cleaner, more comfortable home.

Frequently Asked Questions: Colorado Heat Pump Tax Credits

Can I claim this credit for installations in 2024?

Currently, this guide and the Colorado Heat Pump credit apply to heat pumps installed in 2023. Updated instructions and eligibility details for 2024 installations will be provided soon. Be sure to check back for the latest information!

Does the credit include installation costs?

No, the Colorado Heat Pump Tax Credit applies only to the equipment cost and does not include labor or installation charges. However, upgrades like electrical panels or energy storage systems may qualify.

What if I lease my property?

Lessees qualify for the credit if their installation is approved by the property owner. Make sure to obtain written approval before proceeding.

Can I combine this credit with other rebates or incentives?

Yes! You can combine the Colorado State Heat Pump Tax Credit with federal tax credits and rebates offered by local utility providers. Colorado heat pump incentives vary by region, so checking with your city or county can uncover even more savings opportunities toward the project cost. This could significantly reduce the overall cost of your heat pump upgrade.

What if I need help with the filing process?

Our team is here to support you! If you have questions about your installation or the required documents to receive your heat pump rebates, contact Elephant Energy directly. For specific tax-related concerns, we recommend consulting with a tax professional.

Are there income restrictions for this credit?

No, the Colorado State Heat Pump Tax Credit does not have income restrictions. It’s available to all eligible homeowners and property owners.

Can I claim the Colorado Heat Pump credit if I purchased the equipment but haven’t installed it yet?

No, you can’t claim heat pump rebates in Colorado or the federal tax credit if the equipment hasn’t been installed. These rebate programs require proof of installed equipment, including documentation and signatures. To qualify, ensure registered contractors professionally install your heat pump and complete all paperwork before filing your claim.