What is the Inflation Reduction Act? Wondering how the Inflation Reduction Act will impact you financially? Want to gain a better understanding of home energy rebates and incentives will be available to you? Asking yourself, “What does the Inflation Reduction Act do for me,” or “how do I get money from the Inflation Reduction Act?”

Read on for our guide on the Inflation Reduction Act summary (IRA), including information on tax credits and direct-pay rebates!

The Inflation Reduction Act of 2022 (IRA) is exciting stuff! It’s the largest investment in greenhouse gas reductions – EVER. Passed in August of 2022, the Inflation Reduction Act tax credits for heat pumps, heat pump water heaters, solar, and other #ElectrifyEverything upgrades are available today. Funding will also provide direct-pay rebates for an even broader set of electrical upgrades in the future (hooray!), however these are still in the process of being rolled out, and are not available quite yet.

Some context and definitions…

Tax credits

Tax credits will reduce your taxes the following year. For example, if your heat pump is deployed in 2024, you will receive a tax bill deduction in 2025.

Homeowners should apply for these tax credits retroactively when they file their annual taxes by submitting Form 5695, Residential Energy Credits, alongside their taxes.

The IRA tax credit incentive amount is 30% of the total project installation cost, up to $2,000 maximum. So if your project cost $1,000, you could claim 30% of that ($300). If your project is $10,000, you can claim a $2,000 tax credit. These tax credits will be available to homeowners until 2032.

In addition to the IRA tax credit for heat pumps, homeowners are also able to redeem $1,200 for home improvements related to energy efficiency (think doors at $250/each, limit of $500 total; windows at a $600 limit; and home energy audits at a $150 limit.)

Rebates

People are very curious about what rebates are in the Inflation Reduction Act. Once available, direct-pay rebates will provide an upfront, point-of-sale reduction in the cost of your energy efficiency project (taken right of off your bill). You may also hear these rebates referred to as “HEEHRA” rebates, which stands for High-Efficiency Electric Home Rebates.

Rebates in particular are difficult to forecast timing and amount. Here’s why:

— They are funded by federal dollars and will go to states who apply for them. Once the state is granting funding, they also need to set up programming to deploy their funds. This all takes work – and time!

— Rebates will be income-based (only available to low- and moderate-income households, determined by the Area Median Income where one lives). This means the exact income requirements to qualify differ depending on where you live.

— Each state will decide for themselves total amount per rebate (i.e. up to $8k for a heat pump – but it could also be less, depending on how that state chooses to deploy their funding)

— Only available for the highest tier efficiency equipment (Tier 3).

Eligibility

These incentives are specifically for low and moderate-income households, and eligibility will be determined by the Area Median Income (AMI) where you live. When HEEHRA rebates become available, they should cover up to 100% of electrification costs for low-income households and 50% for moderate-income households. Qualified projects will include heat pump HVAC systems, heat pump water heaters, electric stoves and cooktops, heat pump clothes dryers, new circuit panels, weatherization upgrades (like insulation and air sealing), ventilation, and wiring.

Timing

As mentioned, there is still uncertainty around when HEEHRA rebates will become available. It’s anticipated that some states will roll out rebates over the course of 2024, with the remainder taking their rebates live in 2025.

Stay tuned for updates by signing up for our newsletter (form is located in the footer of our homepage). As more information becomes available, we will also update this guide accordingly.

Equipment Selection

It’s also important to consider equipment selection as only the highest efficiency models (Tier 3) are likely to qualify. Typically, this requires that your equipment have at least a Seasonal Energy Efficiency Ratio (SEER) of at least 18. SEER measures the energy consumption and efficiency of the unit. The higher the SEER value, the less energy the unit will use.

Other Incentives

Depending on where you live, there may be additional incentives and rebates already available to you outside of the IRA. Often, these are city or state rebates, and some utilities also offer rebates for installing a heat pump.

The average homeowner in Denver who installs a heat pump can qualify for an additional $8,000 in incentives between city rebates, local utility, and state tax credits.

The average homeowner in the Greater Boston area who installs a heat pump can qualify for up to $10,000 in additional rebates, as long as the heat pump being installed is the sole source of heating and cooling for the home.

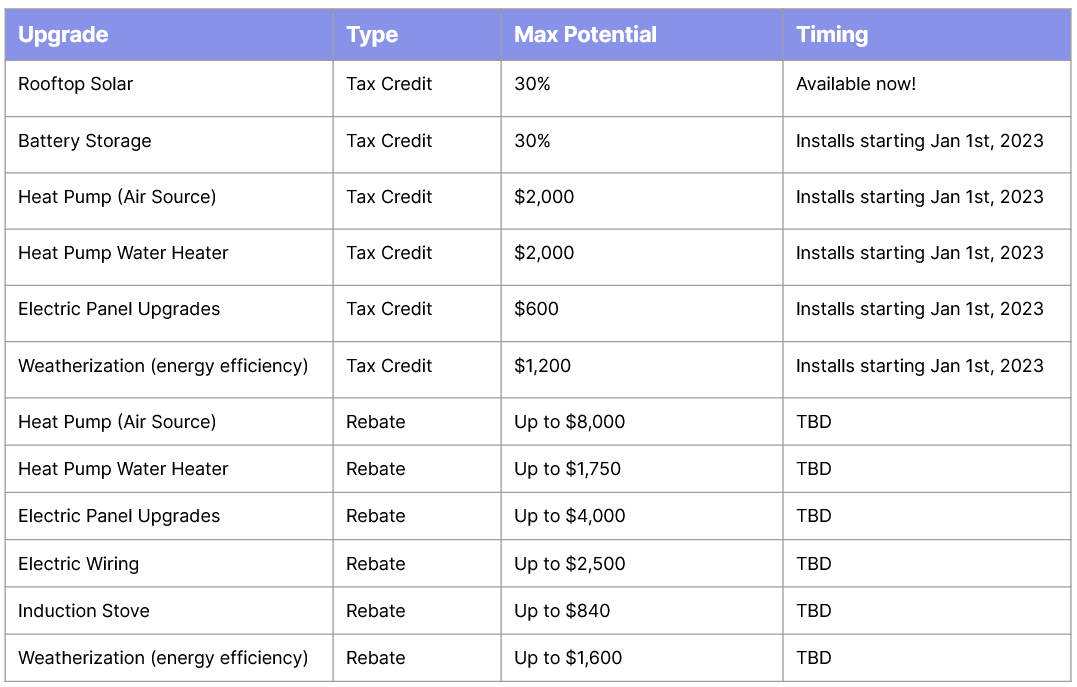

All of the above listed incentives are in addition to the IRA tax credits. While there’s no single database that captures every single incentive available to homeowners across the country, we recommend checking out this website as a starting point for national and state-level rebates. The Inflation Reduction Act affects solar panels, heat pumps, and more. See our chart below for more information.

Summary of Home Energy Tax Credits and Rebates from the Inflation Reduction Act

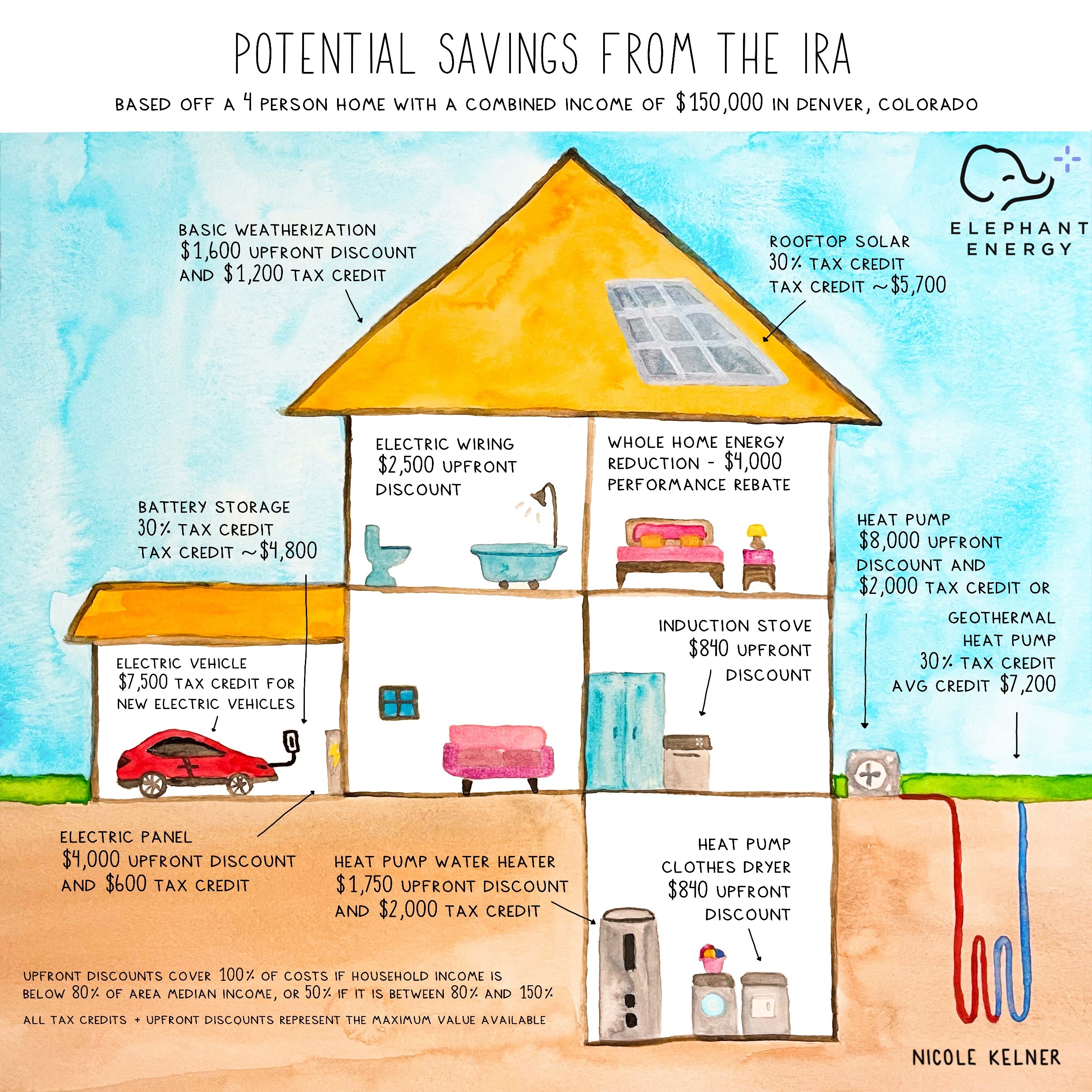

For the visual learners in the room, we also like this handy infographic

Putting it all together – what do IRA rebates and incentives mean for you?

Our advice is dependent on your personal and financial situation

If you need to replace equipment ASAP, do it: The excitement around the Inflation Reduction Act (IRA) likely means supply chains are going to continue to be constrained. As a result, we expect prices – and wait times – to increase in the coming months. We always recommend proactive replacement as opposed to emergency replacement. With the latter, you will get much less say in equipment selection, as you’ll be stuck with whatever equipment is “on the truck”. This is most likely not the best new electric technologies.

If you need equipment in the next 3-6 months: Work with a partner to lock-in equipment and pricing so that you’re guaranteed a spot in their schedule and that you’ll have your equipment of choice. Especially if you’re >2x local Area Median Income (AMI), you most likely will not be eligible for rebates.

If you are #ElectrifyEverythingCurious: Work with a partner to lock-in pricing so that you’re guaranteed equipment and a spot in their schedule. Or, consider waiting until state-level rebates are available to optimize for total cost. Again, if you’re >2x AMI, we do not recommend waiting for rebates as you will most likely be ineligible.

If you want to dig in further into the Inflation Reduction Act and your personal eligibility, check out this awesome calculator from our friends at Rewiring America.

Curious where to start your electrification journey? Get Your Electrification Roadmap® here!

In the Front Range and want a quote from us? Click here to get an instant estimate!